When I look at the overall health of the market for buyers, sellers and investors I look at 3 main components: Affordability, Supply/Demand and Future Demand Expectations. In today’s market update I’m going to use each of these (which all impact each other) to explain why I think now is a great time to buy in Columbus and for some that means that now is the time you should be selling as well.

Affordability

Affordability is at record lows right now. Nationally it’s at places we haven’t seen since the early 80’s when interest rates were over 12%. The same holds true in Columbus and Central Ohio, the average income nationally has to spend almost 40% of GROSS (not your paycheck) on their mortgage payment to buy the “average home”.

This means that many people are priced out of the market. In order to increase affordability, builders are subsidizing interest rates and many sellers are willing to do the same especially if they aren’t selling immediately.

The two fastest ways to get affordability back into line is through decreased mortgage rates or dropping prices. Neither of which are guaranteed in the foreseeable future.

Supply and Demand

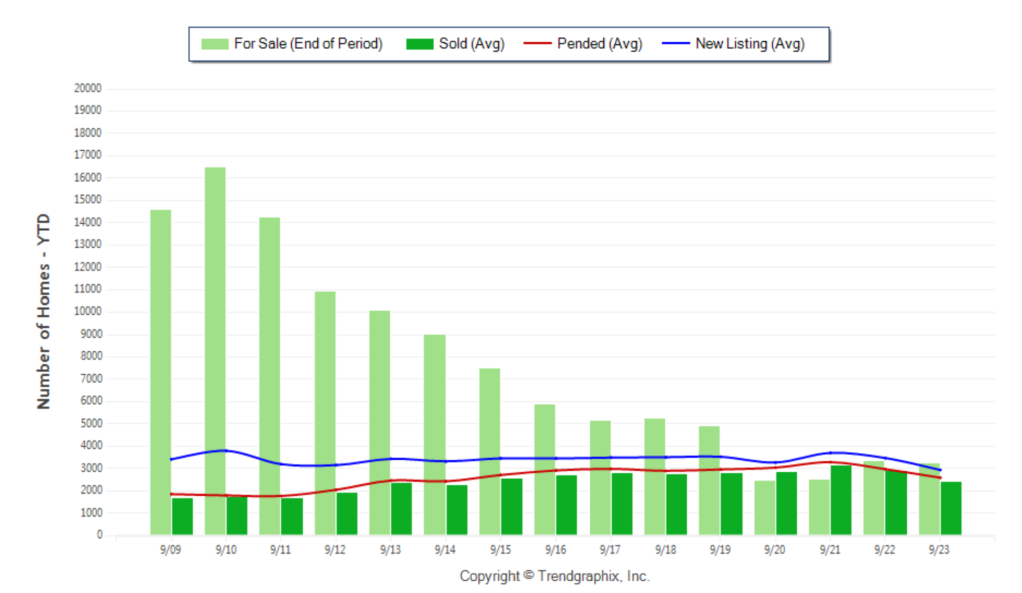

Supply – Inventory (the number of homes currently available to purchase), has remained close to all time lows and has been for most of the year. This continued to be driven by homeowners who don’t want to sell their 3% or 4% interest rate and buy a home at a higher price with an interest rate close to 8%. This is keeping inventory off the market and supply low.

Courtesy of Trendgraphix

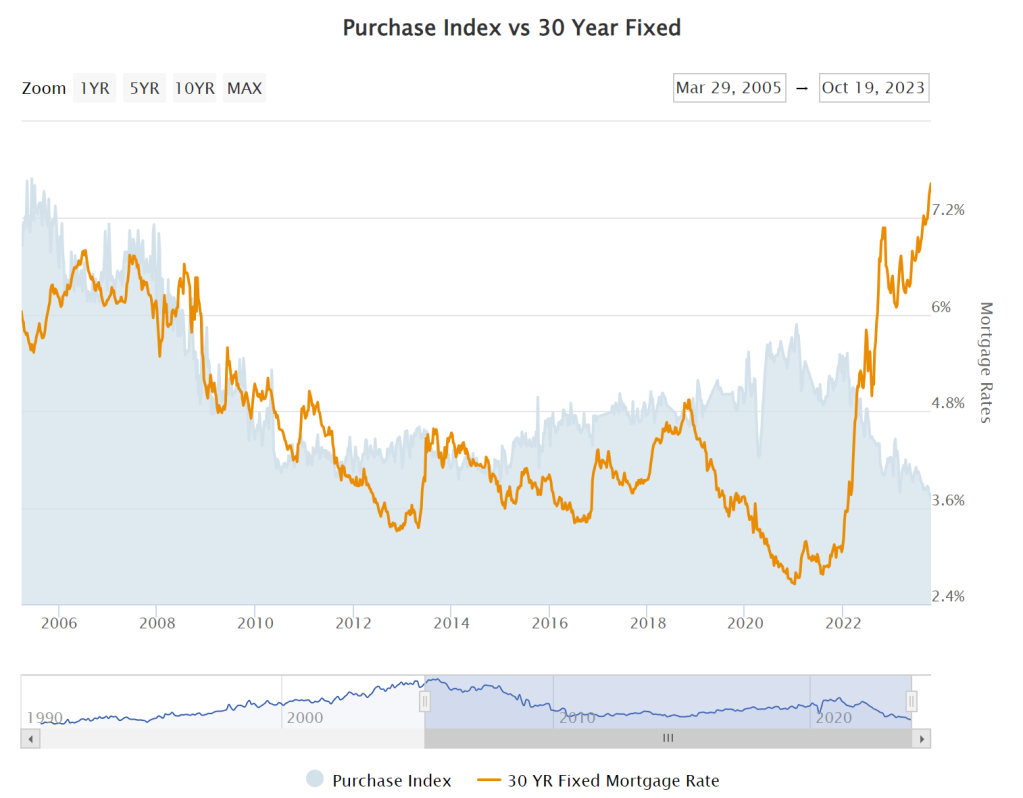

Demand – We typically measure demand by the number of homes we have in contract. That has been a less reliable indicator during the pandemic because the in contract numbers have been kept artificially low by the historically low inventory. The best way I’ve seen to measure demand other than boots on the ground/antidotal evidence is through national mortgage applications. We can see below that the purchase loan index is even lower than it ever got during the Great Recession, yet prices remain stable to due such a low supply.

COURTESY OF MORTGAGENEWSDAILY.COM (click for full article)

Future Demand Expections

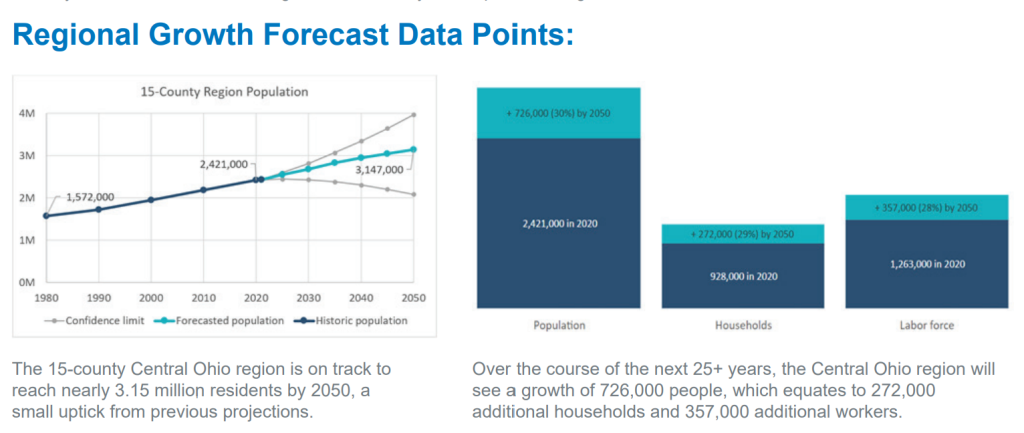

When decided to purchase or sell a home in today’s market you have to look at where you think the housing market is going and where the economy is going in the area that you are purchasing. With businesses moving to Columbus regularly as well as major projects with Intel, Microsoft, Google, Amazon and more, Columbus continues to present a large growth opportunity. Below is a graph from MORPC (Mid Ohio Regional Planning Commission) forecasting the population to grow by 726,000 residents in the next 26 yrs which would bring the total population to over 3.1 million. They have to have somewhere to live.

Click to View Full Article from Morpc.org

Summary – What should I do now!?

With very positive long term growth potential, Columbus is poised to continue growing. Despite a tough few years during the great recession, the Columbus real estate market has come roaring back and far surpassed all expectations. That was before Intel and the other major projects announced their intentions to come to town. With those projects having already begun and new companies announcing relocation here regularly the experts expect the Columbus population to grow pretty significantly (as shown above).

We believe that the current market represents an opportunity to buy without competition that may not present itself again for a while once mortgage interest rates level off. We saw the same phenomenon happen last fall when purchases slowed due to higher rates and then following a drop in rates, the frenzy re-ignited and caused more multiple offer situations and further increased prices. Even with lower demand on the sell side, it is typically offset by the fact that most buyers are moving up in price point when they buy, ironically enough, even downsizing buyers.

That recommendation comes with two caveats:

- You plan to live there for 3-5+ yrs

We believe that if you see yourself living in a home or owning a home (investor) for more than 3 yrs that an investment in Central Ohio Real Estate is a smart one today. If you plan to keep it for 5+ years it’s an even better bet in our opinion. If you plan to own for a year or two, it could be a good time to consider renting or buying a fixer upper that you can add immediate equity to.

2. You can comfortably afford today’s monthly payment or the fully adjusted ARM monthly payment

We think that long term rates will likely come down over the next 1-2 yrs and possibly significantly. If/when that happens a refinance could represent a great opportunity to have locked in today’s pricing, but improve your monthly/annual financial position with a lower rate. We don’t recommend stretching yourself thin or betting that rates will for sure lower in the next 1-2 yrs unless you are fully prepared to pay whatever the current or future adjusted rate would be if you choose an Adjustable Rate Mortgage (ARM).

We specialize in helping people navigate the market of the moment, reach out to us and let us know how we can help you through your current situation!

Leave a comment